Send SOL and Pray: A Data-Driven Dive into 2024 Presales

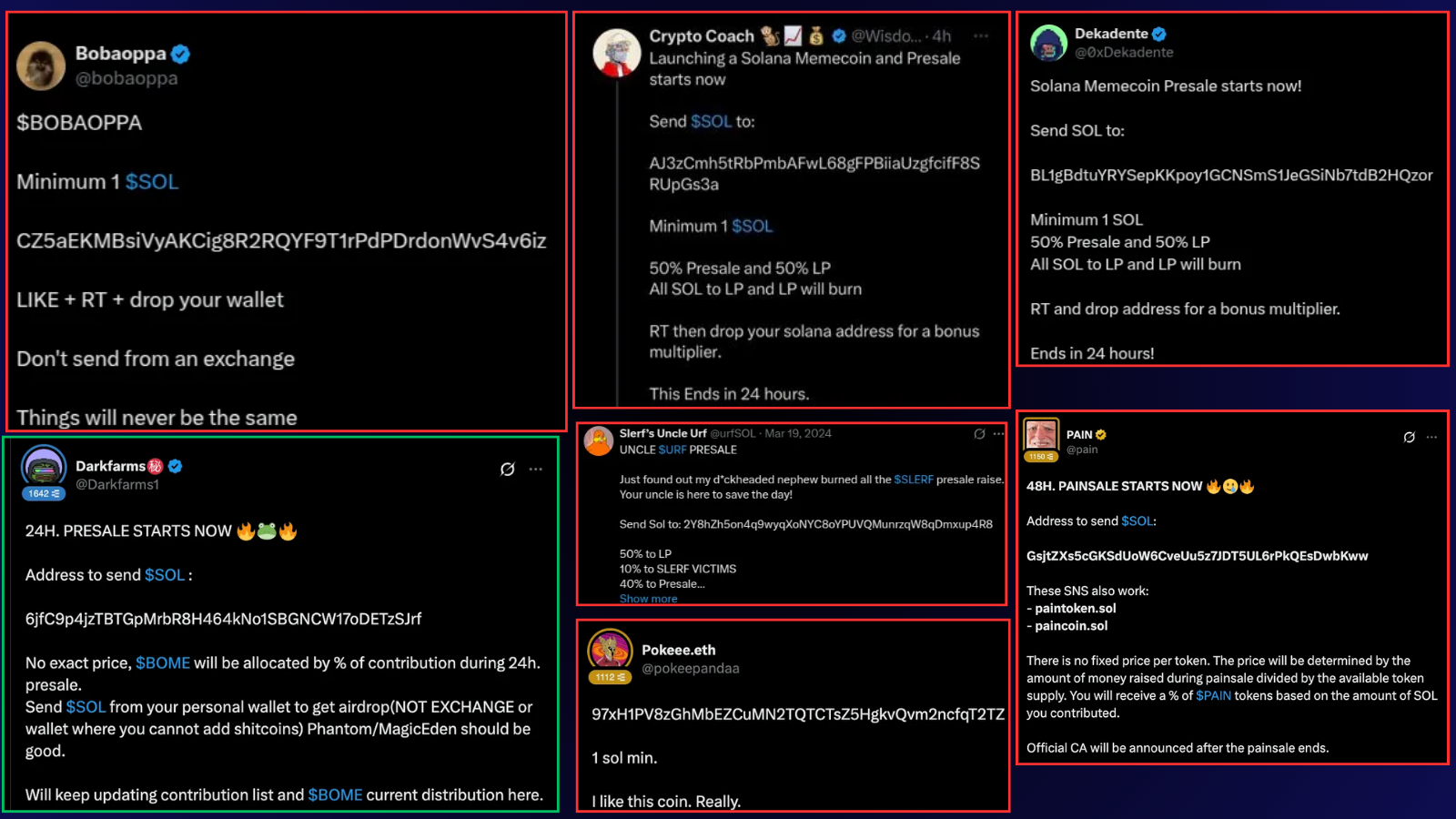

If you missed $BOME, send SOL to this address. Launching soon

If you've come across something like this, chances are you're caught up in Presale Season.

Not sure what that means? No worries. This article breaks it all down in four parts:

1. What is a presale: A simple explanation for those new to the game

2. Returns and profit potential: What kind of gains are possible and how likely they are

3. Where the money is now: An overview of the collected funds with a focus on liquidity

4. The wallets behind it all: A list of key addresses grouped in Arkham entities, plus tools to help you do your own research

By the end, you’ll have a full guide on how to set up the fairest possible presale. Hopefully, you won’t actually use it.

#1 - The presale season: $BOME

The worst trap in crypto is when they try to sell you something based on a single successful event:

Supply control is good — did you see $BRETT?

This memecoin is gonna be listed on Binance, did you see $PNUT?

This presale is going good, did you see $BOME?

This is the story of the 99% of unsuccessful project that you never heard about.

The leading example: $BOME

The whole narrative that leads to more than 100M sent to wallets of strangers on Twitter.

I am not gonna lie, everyone that bought BOME had a really nice return.

We can discuss about the oddly weird Binance listing after a couple of days, the return for early buyer is undeniable.

The trend

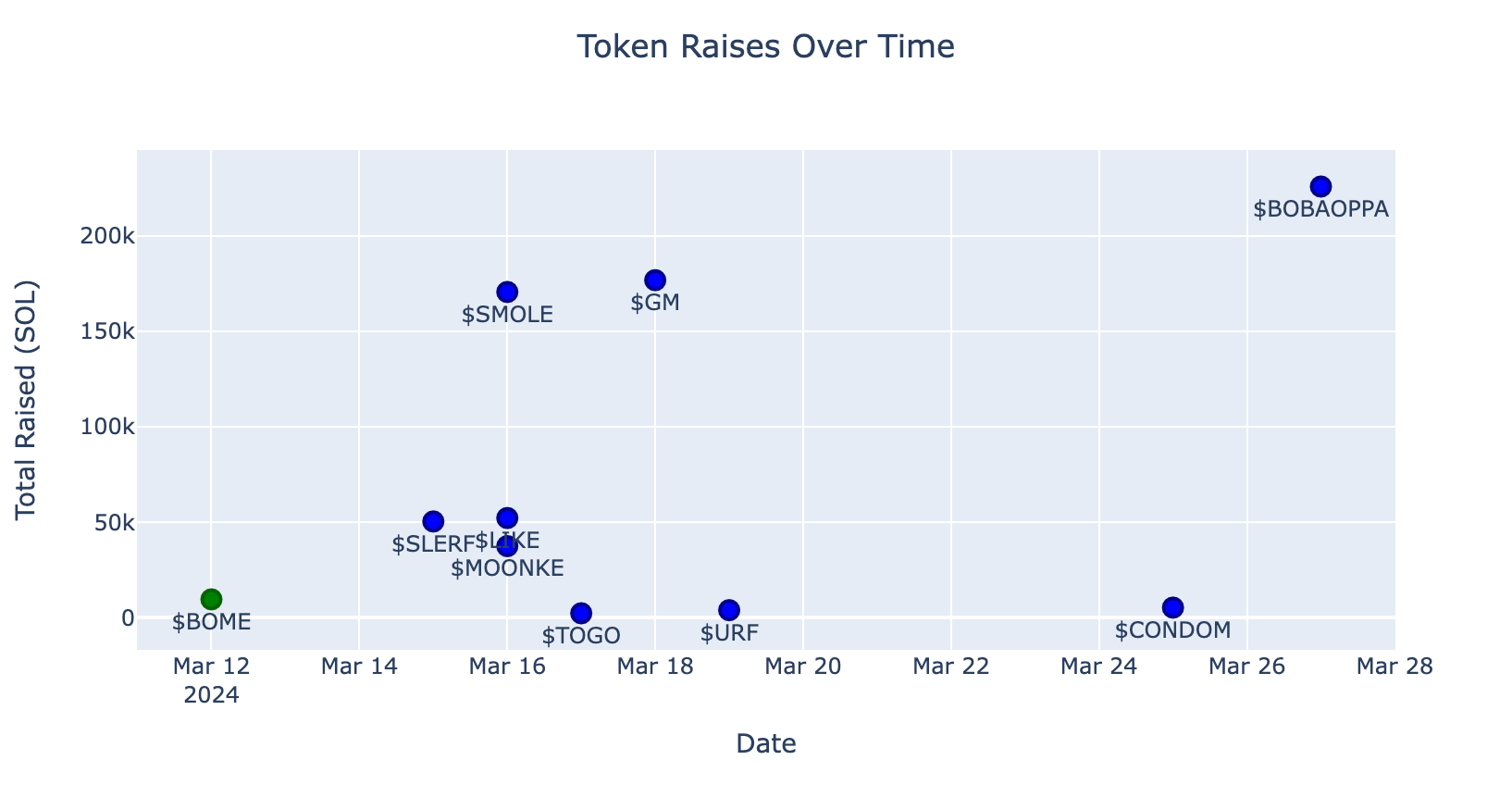

It's not a coincidence that the majority of the following presales happened during March 2024.

After Bome we have multiple tokens that capitalized on this.

The other presales: a bloodbath

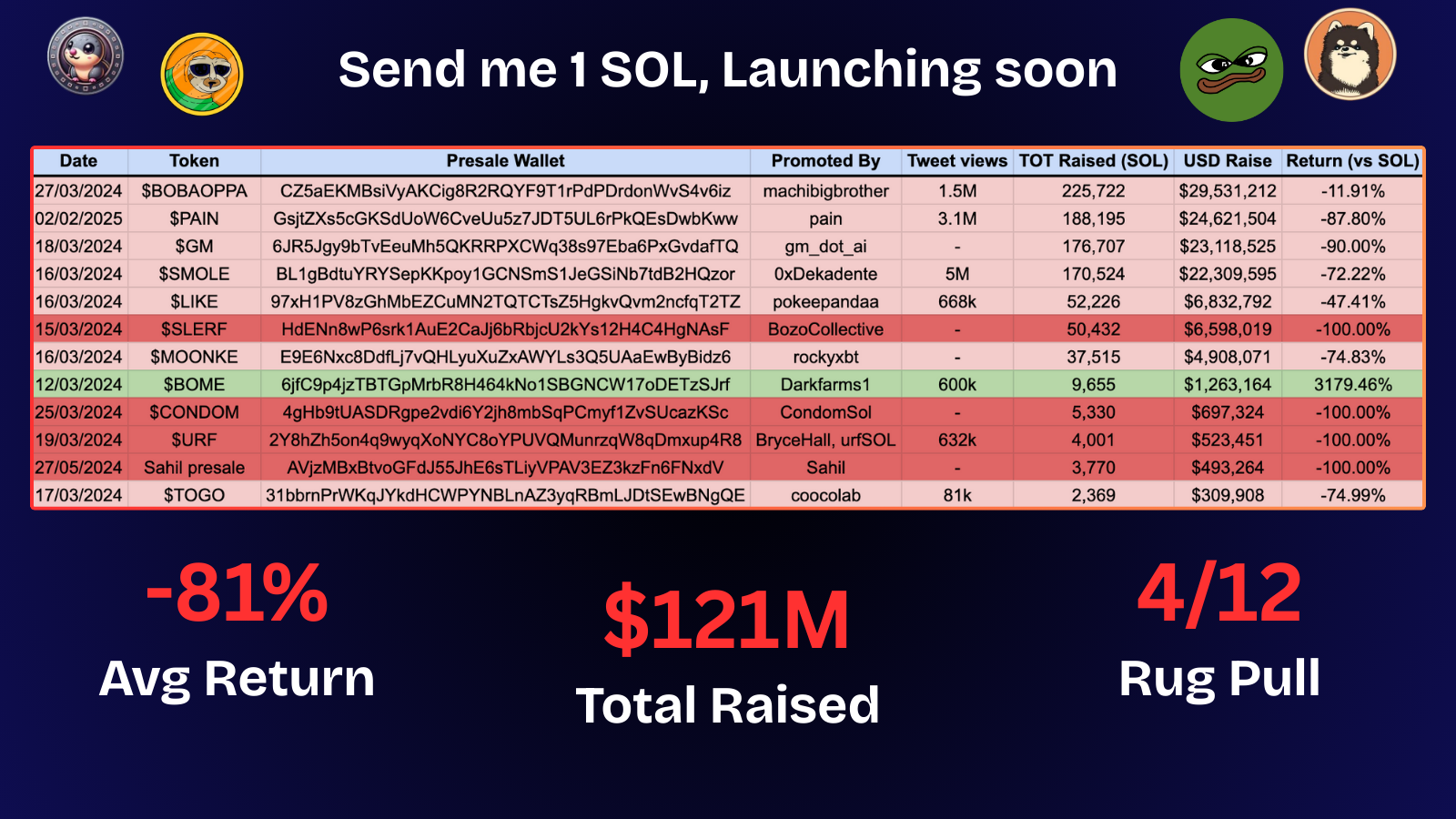

Let’s start with a few key numbers to set the context

• I analyzed 12 presales

• The total amount raised was 926,445 SOL, roughly 121 million dollars

• 4 out of 12 were rugpulls where the token never even launched, sending 8 million dollars straight into scammers' pockets

• Of the remaining 8 tokens, 6 lost at least 70 percent of their value

For the lazy ones, this table sums it all up. You have your headline and you can go spread the news on Twitter.

If you want the full picture, I will walk you through the story in the next section.

#2 - 121M raised, what is the return?

In this section I am describing the path that all those 926,445 Solana followed.

The clearest rugs

Alright, we can immediately write off 63,533 SOL since the token never even launched.

The tweet is gone, the account disappeared, and the owner is probably enjoying early retirement.

Later, we will see where the money went.

| Token | Promoted by | SOL Raised |

|---|---|---|

| $SLERF | BozoCollective | 50,432 |

| $CONDOM | CondomSol | 5,330 |

| $URF | BryceHall, urfSOL | 4,001 |

| Sahil presale | Sahil | 3,770 |

Some interesting stories are:

• $SLERF: The dev accidentally burned half of the raised amount, and the other half was included in the liquidity pool

• Sahil presale: You probably know Sahil. He was behind celebrity scams like $JENNER. He also jumped into the trend, teasing the Iggy Azalea coin and raising a lot of money.

The launched tokens

We are left with 862k of Solana after the first round of rugs.

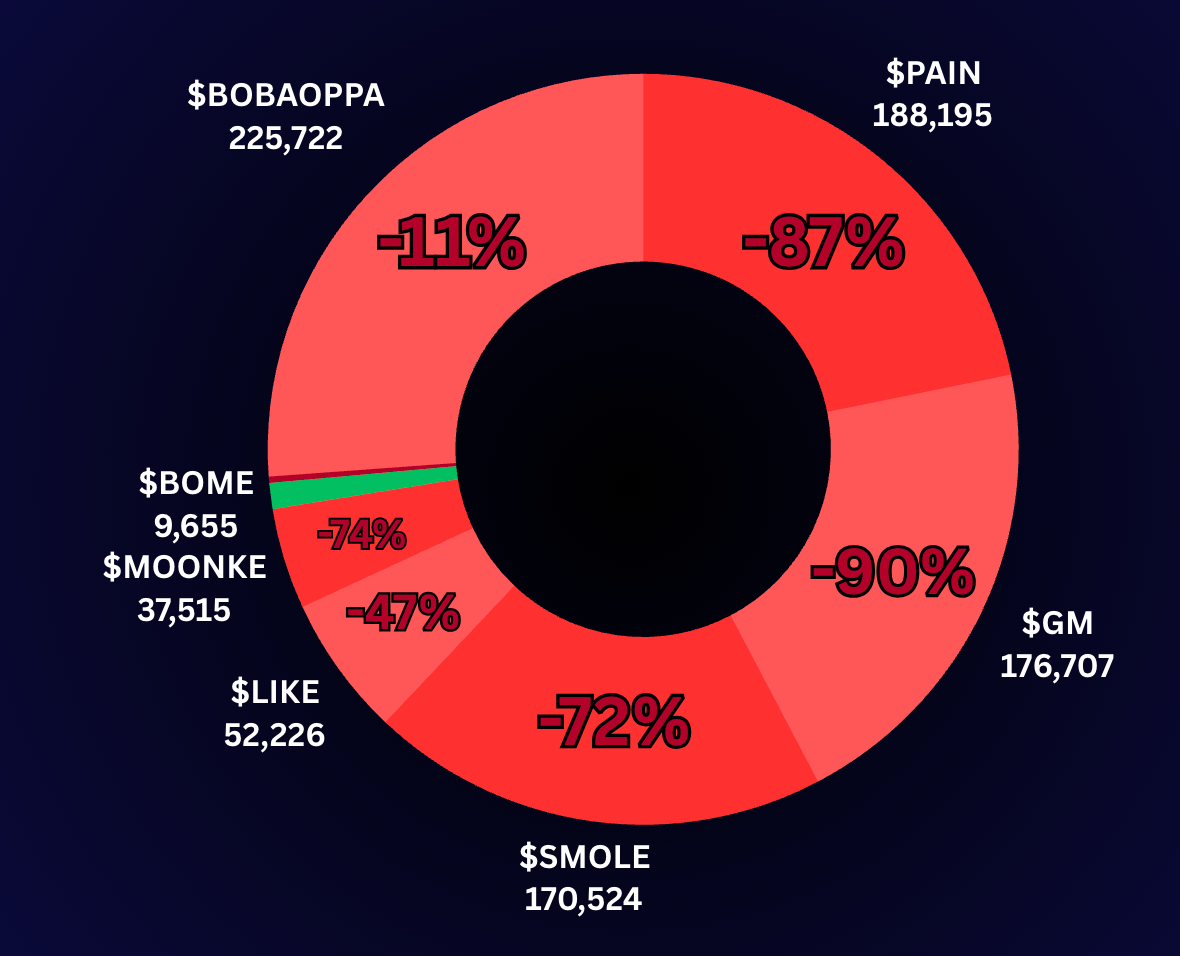

To get a clearer picture, take a look at this chart:

• Red slices represent presales with negative returns

• Each slice shows the performance of the corresponding presale

Bobaoppa: not so bad?

You probably noticed that a huge chunk of the chart comes from a token called Bobbaoppa, promoted by machibigbrother.

While at the current level it might not look that bad, I want to show how hard it actually was to make any profit on this heavily manipulated token.

To do that, let me introduce a metric I just made up: Time Under Water.

Time Under Water (TUW): The percentage of days presalers were in a negative return position.

Everything is gonna be clear with another chart:

Whenever the price enters the purple area, it means presalers are sitting at a loss.

This token is particularly interesting because, for the entire first month, returns were negative across the board. It’s very likely that many presale buyers ran out of patience and sold at a loss.

#3 - Where is the money now?

This section is divided into two parts, based on the type of token.

I’ll distinguish between:

• Real launches – where the focus is on the liquidity that was provided

• Complete rugs – where the focus is on how the money flowed (and vanished)

In the end, I’ll also share all the addresses linked to each project, using Arkham Entities.

Real launches: the liquidity

The funds raised during a presale are meant to support the project’s growth and sustainability.

These projects attempted to do that in the following ways:

• By adding the SOL directly to liquidity pools on platforms like Meteora, Orca, or Raydium

• By setting up buyback mechanisms

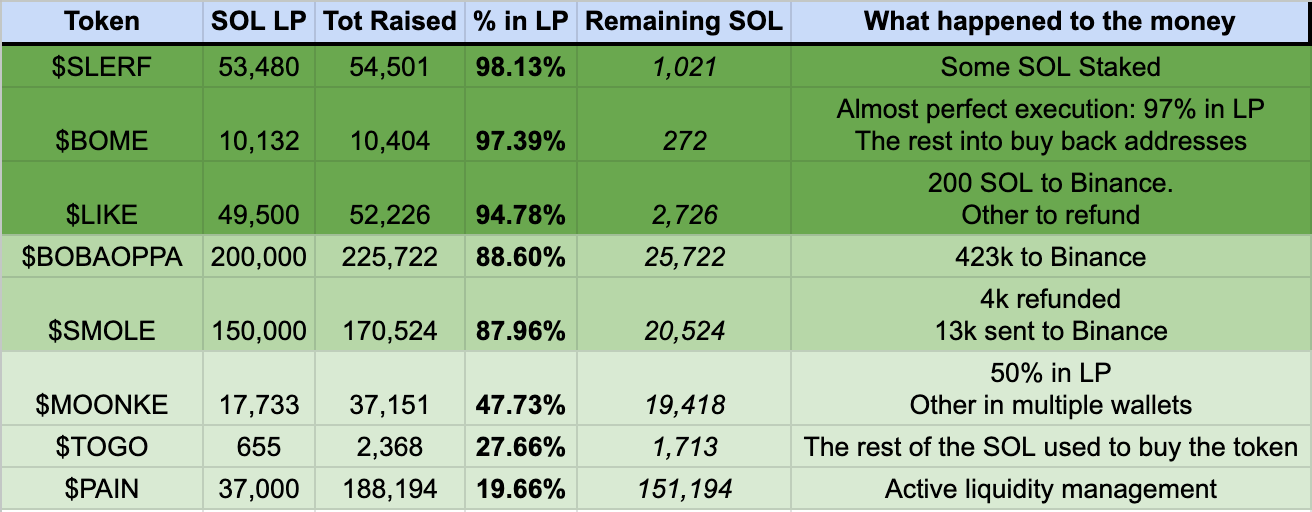

The table below shows the projects, sorted by the percentage of raised funds allocated to liquidity pools.

The business model

The real challenge for these presales is finding the right balance between:

• The profit the project owner wants to take

• The upside they aim to offer buyers

In this analysis I identified different ways for the project to capitalize on the project

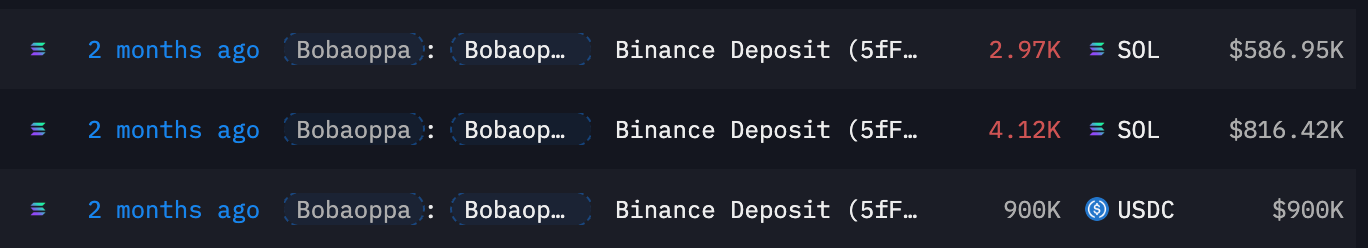

1. The "nobody will notice" strategy

One thing that I learned from crypto is that nobody double check things.

That's what it was leveraged in the first method to take profit.

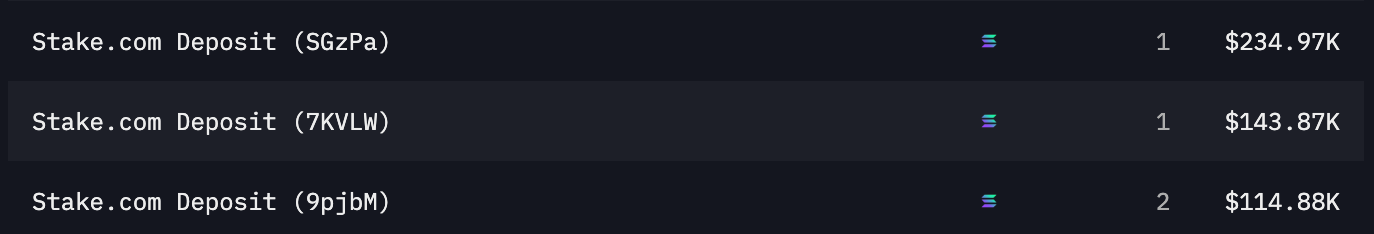

When people send millions of dollars to a single wallet, it get flooded with a lot of transaction and it's a bit difficult to find out if they send a small 500k to Binance:

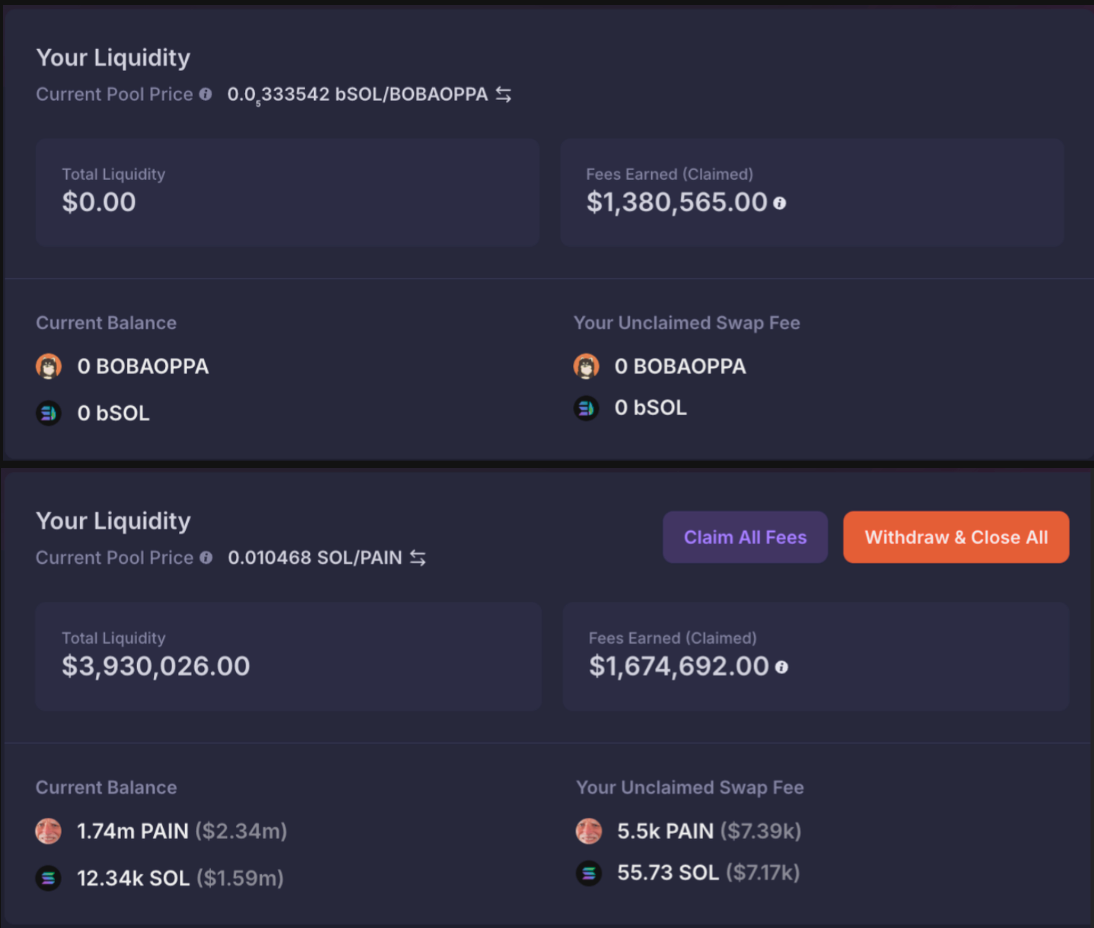

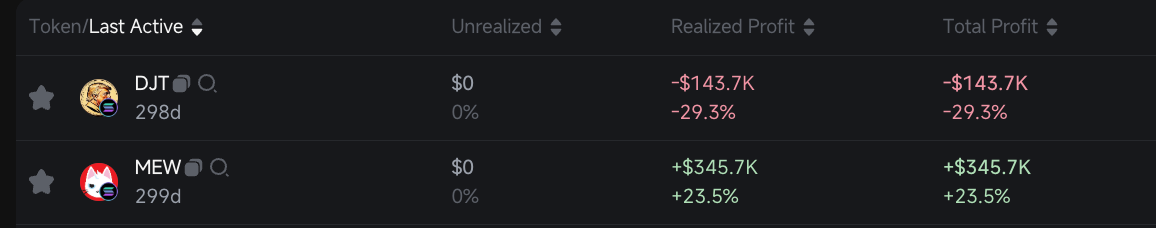

2. The Fee collections

Another way is to set up the liquidity pool and earn from the fees.

This is way more ethical but it has a lot of problems as well.

Just look at the size I am talking about. They will have a huge $MET airdrop.

Full rugs: the money flow

In this section I will tell you the story of the money flow.

If you want the addresses I will give the Arkham entities at the end of the article.

Rug #1: $CONDOM

This token raised 5,330 sol just to delete the Twitter account.

Let's see what happened on-chain.

Rug #2: $URF

If you're a gambler, it's very unlikely you'll stop gambling after receiving 4,000 SOL from a fake presale.

That's the story of $URF.

To be fair, he did use 1,200 SOL to provide liquidity for the $URF token. He actually launched a real token—just forgot the airdrop part.

Now close your eyes and picture the chart before you keep reading.

The rest went through multiple wallet just to finally lend on Mexc, Binance and other CEXes.

Rug #3: Sahil Iggy Azalea's presale

You probably know Sahil. He was pretty big during the celebrity coin season. Somehow he built a solid network and even helped a few celebrities raise money.

But of course, for a scammer money is never enough. Still, it is wild to see people send 300K to someone already known for rugging. And yes, he rugged again.

What happened to the money?

Some of it ended up on Binance, of course, while a large portion was likely used to rug again with small cap tokens—probably the ones he was shilling in his "private" Telegram.

This wallet cluster is really interesting because it clearly shows involvement in other well-known Sahil scams like Lilpump, Jason, and more.

#4 - Do your own research (with my tools)

I always find it valuable to share tools that let others double check my research. It brings two main benefits

• You can help spot any errors I might have missed (in a deep dive like this, mistakes can happen)

• Others can build on my work to dig even deeper

Arkham address list

To track the money flow I used extensively Arkham Intelligence, so why not share the cluster of wallets related to each token?

Rules:

• Start from the presale wallet

• Track any outflow greater than 1K

• Follow the trail recursively

That is how I mapped +100 wallets. You can find everything here:

Presale with a launch

| Token | Arkham Entity |

|---|---|

| $BOME | Bome Cluster |

| $MOONKE | Moonke Cluster |

| $LIKE | Like Cluster |

| $PAIN | Pain Cluster |

| $TOGO | Togo Cluster |

| $BOBAOPPA | Bobaoppa Cluster |

| $SLERF | Slerf Cluster |

| $SMOLE | Smole Cluster |

Presale with a rug

| Token | Arkham Entity |

|---|---|

| Sahil Iggy Azalea's presale | Sahil Cluster |

| $CONDOM | Condom Cluster |

| $URF | URF Cluster |

Flipside dashboard

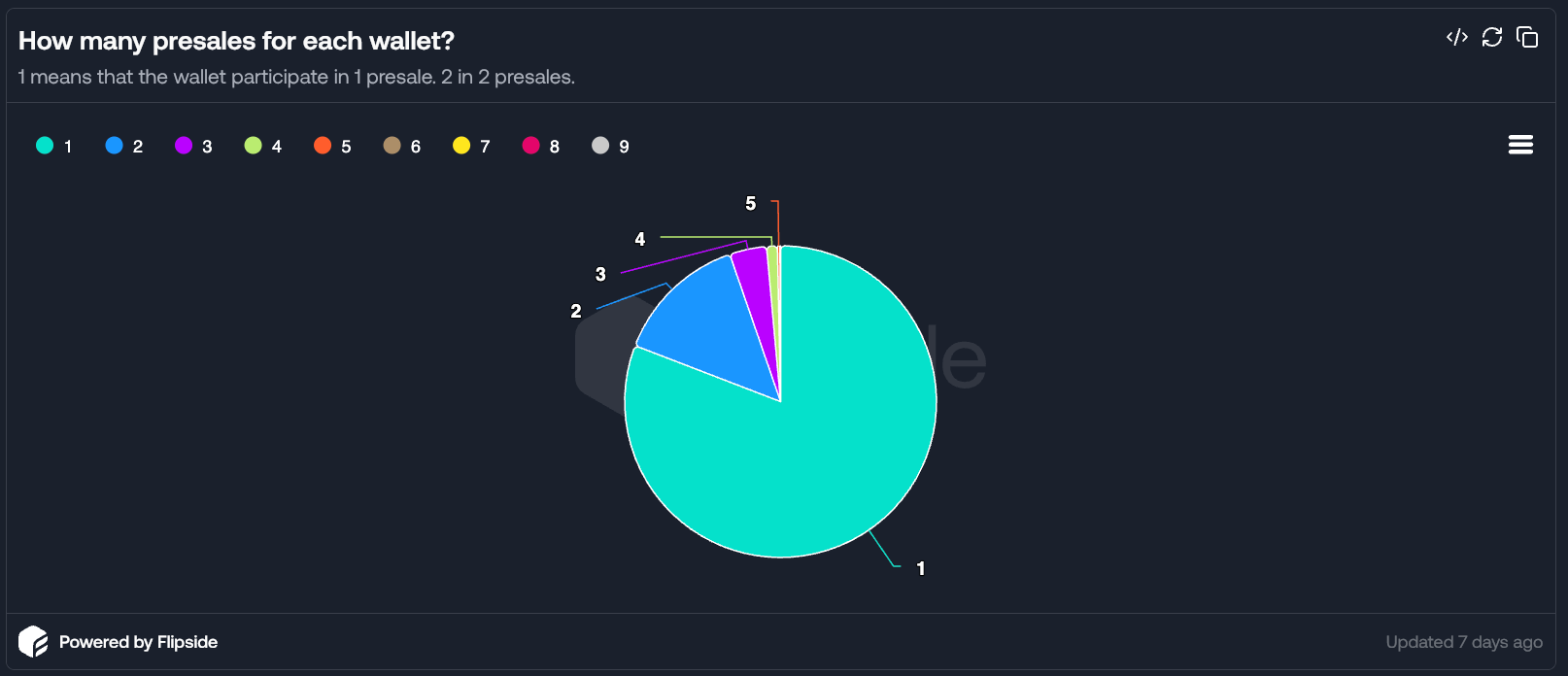

To collect the data about the presale raise and the prices I used the data provided by Flipside crypto.

On my dashboard, you'll find:

• The amount raised by each token

• A simple tool to identify addresses that joined multiple presales

• A presale price calculator (just input the presale wallet, distributor, and token address)

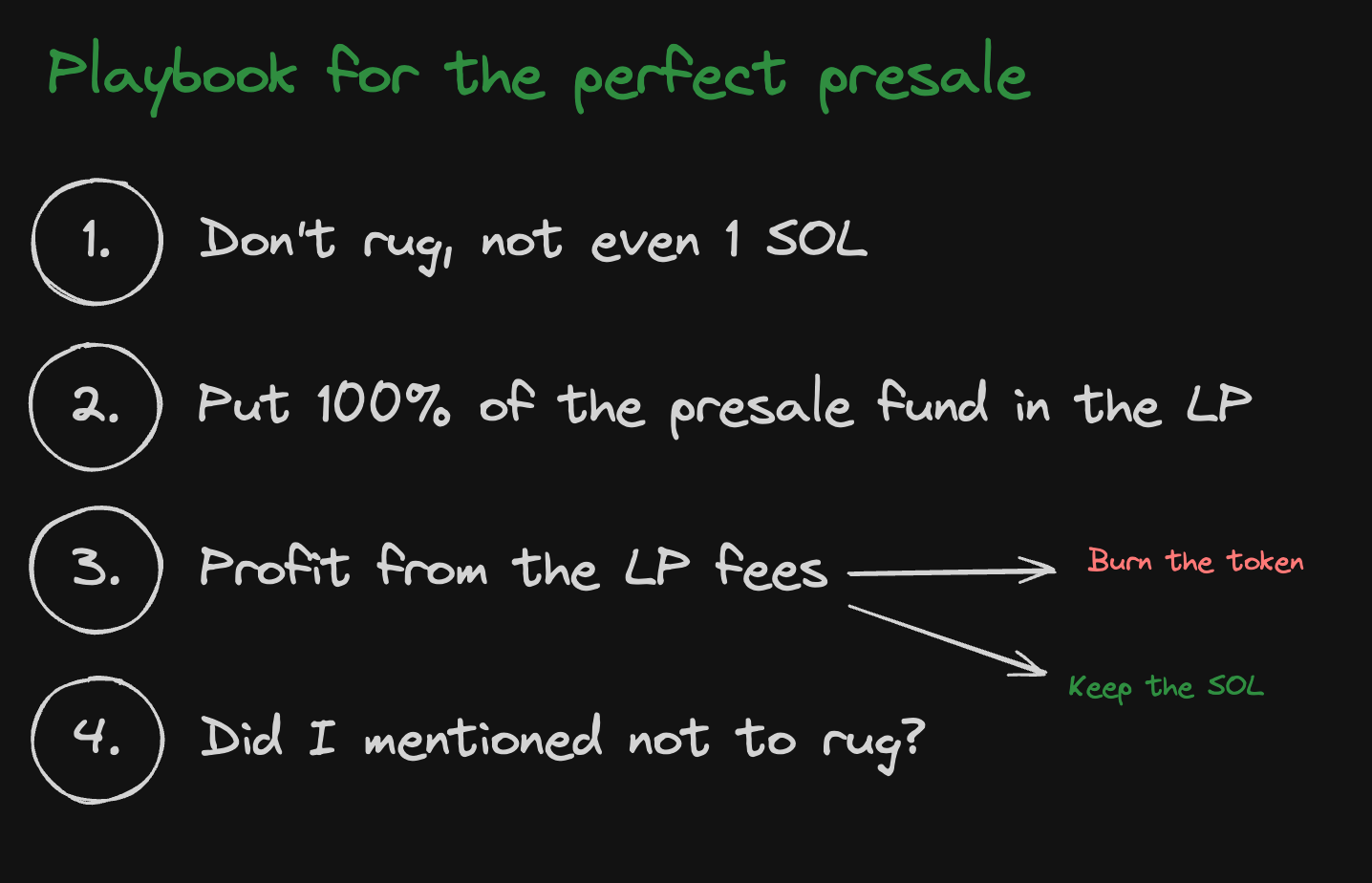

Conclusion: a guide to make a good presale

The clear conclusion here is that, if you missed $BOME or you're not the owners of a big twitter account, you lost money on presales.

By spending hours in this research I think I can recommend some best practice to make a successful presale.

The key, of course, is having a trustworthy team—which, in my opinion, is nearly impossible. If you're handing life-changing money to a stranger, chances are high they'll walk away with at least a couple million.

The most ethical way to profit is by using a pool on Meteora and only taking the SOL (or USDC) portion. You still walk away with six figures in profit, but no one gets rugged.

The goals of the project owners and the presalers should be aligned. If they start pulling in opposite directions, the project is doomed to fail.

So now they I know everything about presale:

Send min 1 SOL. Launching soon.

I am joking, I am not launching anything. But if you appreciate my work I will be more than happy to receive a small donation, the address is real. ❤️

Sources:

• Pricing data from Dexscreener

• Wallet analytics from Flipsidecrypto

• Presale data and account got through Twitter search. A huge help came from ZachXBT list https://x.com/zachxbt/status/1769948459266707961